The Non-Fungible Token (NFT) Industry – Digital Art Meets Cryptocurrency

September 28, 2021

The Non-Fungible Token (NFT) Industry – Digital Art Meets Cryptocurrency

Introduction

On the 9th of September 2021, a set of Non-Fungible Tokens (“NFTs”) comprising 107 images of cartoon apes, were sold for US$24.4 million in an online sale at the Sotheby’s auction house. The 107 NFTs were part of a larger collection of 10,000 computer generated cartoon apes, titled the “Bored Ape Yacht Club”.

A second lot of NFTs comprising 101 “Bored Ape Kennel Club” NFTs (based off dogs as opposed to apes) were sold on the same day, for an additional US$1.8 million.

The combined sale of US$26.2 million worth of NFTs is another milestone in the growing NFT market.

To quote Michael Bouhanna, the co-head of digital art at Sotheby’s, the aforementioned events, in particular, the sale of the “Bored Ape Yacht Club” NFTs, is a “defining moment for the NFT market”.

Art for the Digital Age

With digital art emerging from the ashes of what is stereotypically termed ‘art’, blockchain has found itself an indispensable use within the realm of digital art, in the form of NFTs. NFTs, in relation to digital art, facilitates ownership and transfer of digital art, which are vital mechanisms within the industry. Sotheby’s Auction House’s recent success, as rightfully pointed out by Michael Bouhanna (Co-Head of Digital Art at Sotheby’s), is a “defining moment for the NFT market”, also signalling the rise of a new age of ‘art’.

What are NFTs?

Non-Fungible Tokens or NFTs in crypto parlance, are digital tokens existing on a blockchain. What sets NFTs apart from well-established cryptocurrencies such as Bitcoin and Ethereum, is that each NFT is unique – each possessing a different identification code. Where it is indifferent to trade one Bitcoin for another, trading one NFT for another can be akin to trading a gold ring for a fish, where two NFTs may have nothing in common (apart from being a cryptographic token).

Digital art has carved itself a comfortable little spot within the realm of NFTs. Firstly, being digital, digital art can conveniently be tokenised. Secondly, as no two pieces of art are identical, digital art becomes the perfect candidate for tokenisation.

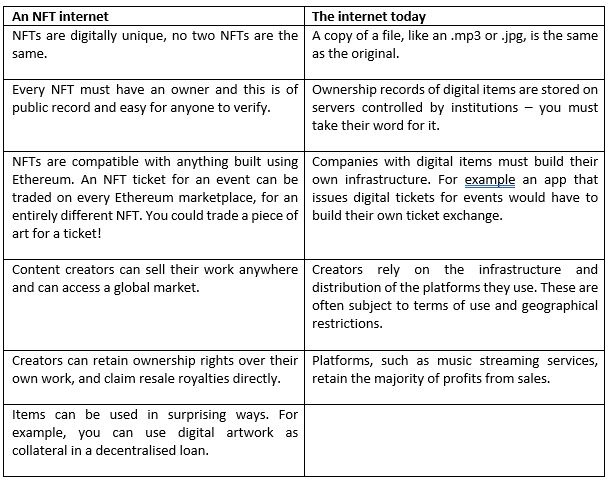

We set out below, a comparison between an internet of NFTs and our use of the internet today (credit to ethereum.org):-

What’s the need for tokenising digital art?

Provability and Verifiability – by virtue of being on a blockchain, information pertaining to NFTs, such as ownership of such NFT is of public record, making it that much easier to verify whether a particular individual own a particular NFT. In contrast, it is difficult (though not impossible) to verify the authenticity and/or origin of physical artworks.

Saleability – being on a blockchain allows (digital) artists to access a global market and sell their work anywhere. Content creators no longer need to rely on designated infrastructure or distribution platform to sell their work on.

Programmability (licensing and royalties) – it can be coded into an NFT such that each time a NFT changes hand, the creator of such NFT (or digital art) directly receives resale royalties. This therefore lowers content creators’ reliance on centralised institution in distributing royalties to them.

Immutability – it cannot be changed or amended in the future, giving the creators of NFTs the power to determine the terms of the NFT.

It should be noted that NFTs are not intended to replace physical art but are rather, in its own market which is robust and thriving.

Regulatory treatment of NFTs in Singapore

Individuals have been arrested in Singapore for providing the services of buying and selling cryptocurrencies without having a valid license under the Payment Services Act No. 2 of 2019 (the “PS Act”). The query of the hour is whether NFTs are brought under the same licensing regime as other cryptocurrencies.

As at the date of this article, the Monetary Authority of Singapore (MAS) has not released any guideline or directions pertaining to NFTs in Singapore. It is easy to leap to the assumption that since MAS elucidated on the issue of NFTs, that is it unregulated. However, we proffer that it is a grey area at best.

Though NFTs are not outrightly mentioned in Singapore regulations, the current regulations applicable to cryptocurrencies could be wide enough to cover NFTs as well.

Under the PS Act, NFTs may be considered “digital payment tokens” if they:-

- are expressed as a unit;

- are not denominated in any currency or pegged to any currency;

- are intended to be, a medium of exchange accepted by the public, or a section of the public, as payment for goods or services or for the discharge of a debt;

- can be transferred or capable of being stored or traded electronically; and

- satisfy such other characteristics as the MAS may prescribe.

NFTs may also subject to regulation under the Securities and Futures Act (Cap. 289) if they constitute securities, capital markets products or units in a collective investment scheme.

Pertinently, the nature and purpose of the NFTs will have to be determined in considering whether the NFTs in questions will be regulated under the laws of Singapore. Additional considerations would include the flow of funds arising from the NFT transactions as well as the rights attached or coded into such NFTs.

Bifurcation of Ownership and IP rights

One common misconception that collectors/purchases have is that the ownership of NFTs would result in the ownership of the copyright in the same.

This is however, inaccurate on the basis that NFTs are just tokens that represent an asset and are completely separate from the underlying asset (which the NFT represents).

Instead, owners of NFTs may own nothing more than unique metadata on the blockchain.

Ownership of the NFT itself also does not prevent anyone else from downloading and viewing the digital artwork.

The issue of copyright is even more complex given that some platforms allow users to mint art pieces or digital content without verifying whether said user is actual creator of the art being tokenised. One such example had occurred in early 2021, where a NFT tweet-minting bot, known as “@tokenizedtweets” had minted several NFTs based off viral tweets from various content creators (on Twitter) without their consent.

Overall, the law has yet to fully catch up with the rise of NFTs over the course of the year. The legal ambiguity surrounding the regulatory status of NFTs, as well as the relationship between NFTs and copyright, is something that regulatory bodies and governments will have to move quickly to deal with.

This update is provided to you for general information and should not be relied upon as legal advice.

Chambers & Partners – Asia Pacific 2023

PDLegal LLC is pleased to announce that Managing Partner, Peter Doraisamy, has been recognised and ranked by Chambers & Partners (Asia Pacific 2023 for Shipping: Domestic: Litigation). The following quotes appear with Peter’s ranking: –

“Peter Doraisamy of PDLegal in Singapore is a noted shipping lawyer in the market. He handles a wide range of disputes, including ship grounding, cargo and fraud-related cases” – Chambers & Partners – Asia Pacific 2023

“He is excellent in litigation. He has very good control of the case, collecting the right evidence and putting this into a very successful trial.” – Shipping Litigation Client

Chambers and Partners is the leading independent professional legal research company operating across 200 jurisdictions. Chambers and Partners delivers detailed rankings and insights into the world’s leading lawyers and law firms.

This ranking is a testimony to the expertise and experience of the Firm’s shipping practice and would not be possible without the support of our clients and friends.

View All Awards

We’re here to help you.

Whether you're seeking advice, representation, or have general inquiries, we're here to help. if you would like to speak to us for more information, please contact our client services team who will be happy to assist.

Let's Get In Touch

Our Office

- A:

PDLegal LLC Advocates & Solicitors 1 Coleman Street #08-02 The Adelphi Singapore 179803

- E:

- T:

- F:

(65) 6220 0392

- H:

Mon - Fri : 9:00 am - 5:00 pm Sat : 8:30 am - 12:00 pm