Legal and Compliance Requirements for Setting up a Fund Management Company

14 September 2021

Legal and Compliance Requirements for Setting up a Fund Management Company

Singapore is a hub for global and local asset managers in the Asia-Pacific region, making it a preferred and trusted domicile for funds. Our previous article[1], published in December 2020, covered the Variable Capital Companies (VCCs), a flexible corporate structure introduced fairly recently in Singapore, designed for investment funds.

This article covers key legal and compliance requirements as well as general guidelines applicable to the setting up of fund management companies. We discuss:

- various types of fund management companies available in Singapore;

- the licensing and registration requirements for the different types of fund management companies; and

- the admission criteria and requirements when applying to set up a fund management company.

Definition of Fund Management

“Fund management”, as referred to in the Securities and Futures Act (Cap 289)(“SFA”), means:

- Managing the property of, or operating, a collective investment scheme; or

- Undertaking on behalf of a customer (whether on a discretionary authority granted by the customer or otherwise), not including real estate trust management, the (i) management of a portfolio of capital markets products; or (ii) entry into spot foreign exchange contracts for the purpose of managing the customer’s funds.

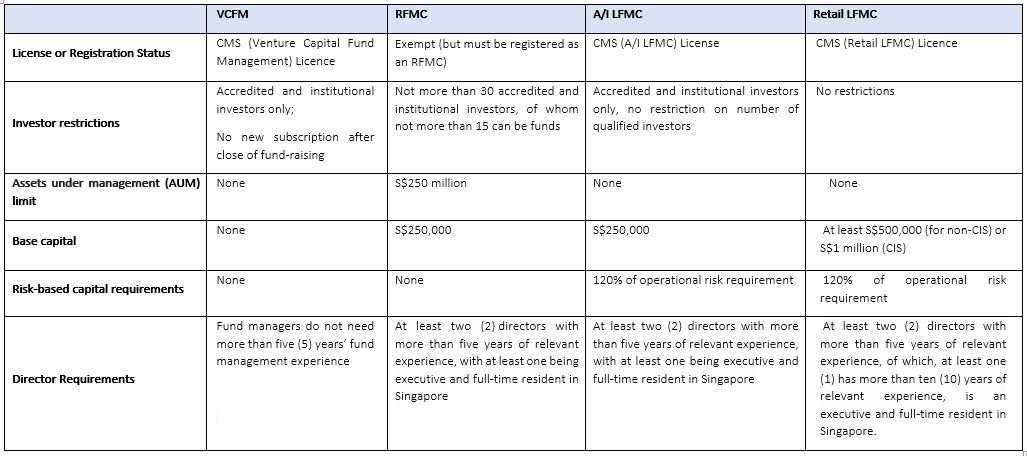

To conduct regulated fund management activities under the SFA, a company must be registered with the Monetary Authority of Singapore (MAS) or hold a Capital Markets Services (CMS) licence to operate either as a Registered Fund Management Company (RFMC), a Licensed Fund Management Company (LFMC), or a Venture Capital Fund Manager (VCFM). The relevant requirements for the setting up of each type of fund management company are set out in the table below.

Further, note that individuals performing key functions in a fund management company, such as portfolio construction and allocation, research and advisory, business development and marketing or client servicing are required to be “representatives”. To meet the requirements of being a “representative”, such individual needs to:

- Be at least 21 years old;

- Satisfy the minimum academic qualifications and examination requirements[1]; and

- Satisfy the fit and proper criteria according to the MAS Guidelines on Fit and Proper Criteria[2].

Fund Management Licensing (Registration or Exemption) Regime

We set out below the general guidelines, eligibility criteria and application procedures for Licensed Fund Management Companies (LFMCs), Venture Capital Fund Managers (VCFMs), and Registered Fund Management Companies (RFMCs).

Fund management companies (namely LFMCs, VCFMs and RFMCs) should also meet ongoing business conduct requirements, such as requirements relating to custody, valuation and reporting, conflicts of interest mitigation, disclosure and submission of periodic returns. These are set out in the MAS Guidelines on Licensing, Registration and Conduct of Business for Fund Management Companies.

What are the admission criteria and applicable requirements?

When assessing an application to be an RFMC, LFMC or VCFM, the MAS takes into account factors such as:

- Fitness and propriety of the applicant, its shareholders, directors, employees as well as the company itself in accordance with the MAS Guidelines on Fit and Proper Criteria.

- Track record and fund management expertise of the applicant and its parent company or major shareholders.

- Competency of key individuals such as the CEO, directors, and relevant professionals in the company, taking into consideration whether such persons have adequate experience relevant to fund management. Directors of the company should collectively have experience in portfolio management (including experience in asset classes or markets the company intends to invest in) and other support functions such as risk management, operations, and compliance.

- Ability to meet the minimum financial requirements prescribed under the SFA.

- Strength of internal risk management and compliance systems.

- Business models, plans, projections, and the associated risks.

Reference Materials:

The following materials are available on the MAS website:

- MAS’ 2020 Licensing and Registration Report (Published on 1 June 2021);

- FAQ on Licensing and Registration of Fund Management Companies;

- Guidelines on Licensing, Registration and Conduct of Business for Fund Management Companies

- MAS Guidelines on Fit and Proper Criteria

- MAS Website on Asset Management Industry and 2019 Asset Management Survey

This update is provided to you for general information and should not be relied upon as legal advice.

Chambers & Partners – Asia Pacific 2023

PDLegal LLC is pleased to announce that Managing Partner, Peter Doraisamy, has been recognised and ranked by Chambers & Partners (Asia Pacific 2023 for Shipping: Domestic: Litigation). The following quotes appear with Peter’s ranking: –

“Peter Doraisamy of PDLegal in Singapore is a noted shipping lawyer in the market. He handles a wide range of disputes, including ship grounding, cargo and fraud-related cases” – Chambers & Partners – Asia Pacific 2023

“He is excellent in litigation. He has very good control of the case, collecting the right evidence and putting this into a very successful trial.” – Shipping Litigation Client

Chambers and Partners is the leading independent professional legal research company operating across 200 jurisdictions. Chambers and Partners delivers detailed rankings and insights into the world’s leading lawyers and law firms.

This ranking is a testimony to the expertise and experience of the Firm’s shipping practice and would not be possible without the support of our clients and friends.

View All Awards

We’re here to help you.

Whether you're seeking advice, representation, or have general inquiries, we're here to help. if you would like to speak to us for more information, please contact our client services team who will be happy to assist.

Let's Get In Touch

Our Office

- A:

PDLegal LLC Advocates & Solicitors 1 Coleman Street #08-02 The Adelphi Singapore 179803

- E:

- T:

- F:

(65) 6220 0392

- H:

Mon - Fri : 9:00 am - 5:00 pm Sat : 8:30 am - 12:00 pm