Corporate Tax in Singapore – A Law Firm’s Guide

Overview Of Corporate Tax In Singapore

Singapore is known to be one of the most influential countries in reducing its corporate income tax rates and offering various tax exemptions to attract investments to the country. Singapore has a flat-rate corporate income tax system, where all companies are taxed at a single-tier flat rate of 17%. In addition to a comprehensive tax framework, Singapore also offers honest tax policies, tax exemptions, and incentives for businesses.

Furthermore, Singapore is dubbed Asia’s top country for ease of doing business by the World Bank, evident from the number of multinational companies setting up APAC headquarters in this city-state.

Headline Corporate Tax Rates In Singapore

Singapore’s headline corporate tax rate is a flat rate at 17%.

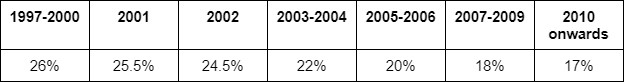

Historically, headline corporate tax rates started at 26% in 1997, and the number has been decreasing consistently over the years in a bid to attract a higher level of investments to the country.

It is important to note that the headline income tax rate may not necessarily reflect the accurate effective corporate income tax rate. Due to the availability of tax exemptions and tax incentives, the effective corporate income tax rate is often lower than the headline corporate tax rates.

What’s The Difference Between Net Income and Taxable Income?

There is a difference between a company’s taxable income and its net income. The calculation of taxable income for a company begins with the net profits and losses in the company’s income statement. Making various adjustments in the calculations helps you arrive at the taxable income for the given accounting year. The adjustments made consist of the non-deductible expenses incurred by your company for tax purposes. Similarly, some income received by the company may not be taxable, or it could be taxed separately as a non-trade source income.

A Singapore company is taxed on income accrued in or derived from Singapore. Income received from outside Singapore is also subjected to applicable tax exemptions and reliefs.

Such income includes:

- Gains or profits from any trade or business

- Income from investment such as interest and rental

- Royalties, premiums, and any other profits from property

- Other gains of an income nature

To calculate the taxable income of a company, the following adjustments are made to its net profit/loss data:

- Deduct non-taxable income. Income of non-taxable nature is deducted from the chargeable income.

- Adjust net investment income. Investment income is considered non-trade income. Investment income for income tax calculation purposes is assessed separately because an excess of expenses over the income received from one source of investment cannot be claimed against the surplus arising from another source of investment.

- Deduct qualified business expenses. Deductible expenses are expenses that are wholly and exclusively incurred in the production of trade income.

- Deduct capital allowances. Expenditure incurred on the purchase of fixed assets is not deductible for tax purposes as it is capital in nature. Depreciation on fixed assets is also not deductible as it only lowers the book value of assets and is not an actual expense incurred by the company. Rather, the company can claim capital allowances, which offer a deduction for the wear and tear of fixed assets. Unutilised capital allowances from previous and current accounting periods can be deducted in the current financial year.

- Deduct unutilised losses. Qualified losses that arise from the carrying of a business and have not been utilised previously, can be deducted against the company’s income in Singapore. The deduction of losses follows the preceding year basis. If the losses cannot be fully adjusted in the current year of assessment, the remaining portion can be carried forward to the next year.

- Deduct unutilised donations. Only donations that are made to approved institutions of a public character can be deducted from the company’s income to arrive at its taxable income.

Partial Tax Exemptions For Companies In Singapore

To maintain its business-friendly reputation, Singapore offers numerous incentives to attract overseas companies to set up new offices in Singapore. In line with this goal, the partial tax exemption is an initiative rolled out by the Singapore government. Eligible companies may qualify for partial tax exemptions that help reduce tax bills on newly set-up companies. These tax incentives make Singapore well-positioned in the business environment, maintaining its competitive advantage in today’s global business world.

Industry-Specific Tax Incentives In Singapore

This section will provide a detailed overview of the variety of industry-specific tax incentives in Singapore by virtue of the Singapore Income Tax Act.

Tax Incentives for Financial Services Industry

There are various tax incentives for the financial services industry, including:

- Traditional income

- Fee income

- Withholding tax exemption for Over-The-Counter (OTC) financial derivatives payments

These schemes offer concessionary tax rates and withholding tax exemptions to qualifying companies.

Tax Incentives for Banks

Tax incentives include the Liberalization of the Withholding Tax Exemption Regime for Banks.

For all banks that meet the eligibility criteria, interest and other qualifying payments that are made to all non-resident persons in relation to their trade or business will be granted a withholding tax exemption.

Tax Incentives for Fund Management Industry

As an attractive location for fund management companies, there are various tax benefits and efficient policies in registering a fund management company in Singapore.

Tax incentives include:

- Tax exemptions for qualifying offshore funds

- Tax exemptions for qualifying onshore funds

- Concessionary corporate income tax rates for Fund Managers

Tax Incentives for Global Trading Companies

The Global Trader Scheme grants eligible global trading companies a concessionary tax rate of 5 to 10%. Depending on the company’s turnover and spending, the grant is deductible on approved offshore trade incomes. The duration of the grant will be a period of 5 to 10 years. The company should be well-established with proof of a track record of international trade.

Tax Incentives for Shipping & Maritime Industry

There are various incentives for the shipping and maritime industry to attract shipping companies to develop and establish their business in Singapore.

The Maritime Sector Incentive (MSI) scheme includes:

- Maritime Sector Incentive – Approved International Shipping Enterprise (MSI-AIS) Award

- Maritime Sector Incentive – Maritime Leasing (MSI-ML) Award

- Maritime Sector Incentive – Shipping-Related Support Services (MSI-SSS) Award

- Withholding tax exemptions

Tax Incentives for Tourism Industry

Qualifying companies can receive tax deductions from their taxable income for either inbound tourism promotions or their participation in local trade exhibitions. These incentives are subjected to the fulfilment of a set of eligibility criteria.

Tax Incentives for Event Organizers

Companies specialising in event organisation are eligible for a 10% concessionary tax rate on corporate taxable income derived from mega-events. Mega-events are events that can attract many visitors with a large outreach but are usually very costly.

Tax Incentives for the eCommerce Industry

To build Singapore to be a leading e-commerce hub, qualifying e-commerce companies can receive a concessionary corporate income tax rate of 10%, instead of the single-tier flat-rate corporate income tax of 17%. The taxable income should be derived from cross-border e-commerce transactions outside of Singapore. The reduced tax rate is given for a period of 5 years.

Tax Incentives for Approved Ventures

Approved ventures are eligible for a concessionary corporate income tax rate of 0 to 10%. The income should be derived from qualifying investments from the approved ventures. The period of concessionary tax rates will be decided by relevant authorities and unique for each venture.

Tax Incentives for Headquarters Activities

There are two specific schemes that offer incentives for companies to set up their regional or global headquarters in Singapore. The incentives are the Regional Headquarters Award and the International Headquarters Award. Under these awards, companies can enjoy a concessionary tax rate for a few years on incremental qualifying income from abroad, rather than the single-tier flat-rate corporate income tax rate of 17%.

Tax Incentives for Processing Services Company

Eligible companies providing processing services are taxed with a concessionary tax rate of 5% on corporate income. The income should be derived from the provision of the prescribed processing services to financial institutions. This tax break is given for a period of 5-10 years.

Tax Incentives for Legal Firms

Law firms in Singapore can enjoy a concessionary tax rate of 10% on incremental corporate income. The incentive is valid if the income is derived from eligible international legal services. Eligible law firms can also enjoy tax exemptions of up to 50% on incremental qualifying income derived from international arbitration cases heard in Singapore.

Tax Incentives for R&D, Innovation and Product Development Activities

There are a variety of schemes that seeks to encourage R&D, innovation, and product development activities in Singapore.

These include:

- Development and Expansion Incentive (DEI)

- Investment Allowance

- Pioneer Incentive Scheme

- Productivity and Innovation Credit (PIC) Scheme

Under the various schemes, qualifying companies can enjoy either a concessionary tax rate or tax exemptions.

Avoiding Double Taxations (For Foreigners and Foreign Companies)

Double Taxation Agreements (DTAs) are agreements that are drafted between Singapore and another country. These agreements help individuals avoid the double taxation of income earned in one jurisdiction by a resident of the other jurisdiction.

A DTA accounts for the taxing rights between Singapore and another jurisdiction partner. It may allow for tax reductions or exemptions for certain kinds of income. The agreement mainly details the different types of incomes that could arise from cross-border economic activities between the two jurisdiction partners.

Beneficiaries of the DTAs must be Singapore tax residents and tax residents of the jurisdiction partners.

How to enjoy the benefits of the DTA

Firstly, it is imperative to check the list of treaty partners to find out if the company is eligible to enjoy the benefits of the DTA.

For eligible companies, when the company earns a foreign income from eligible jurisdictions, claiming the benefits under the DTA exempts the company from taxes in the foreign jurisdiction. In some cases, the taxes are reduced instead of being entirely exempted. The foreign income received will then still be taxed in foreign jurisdictions.

To claim the benefits under the DTA, the company will be required to submit a Certificate of Residence to the foreign jurisdiction, proving that the entity is a Singapore tax resident.

If the company is a tax resident of Singapore’s partner jurisdictions, it can also enjoy the benefits of the DTAs when they receive income from Singapore. To claim the benefits under the DTA, the company will be required to provide proof that they are a tax resident of the partner jurisdiction. A completed Certificate of Residence from Non-Residents should be duly certified by relevant tax government authorities of their country of residence. These documents of proof must be submitted to the Inland Revenue Authority of Singapore (IRAS).

Why Consult A Law Firm Regarding Your Corporate Tax Matters In Singapore

In general, filing taxes can be complex and technical without relevant training. There exists a sheer number of relevant documents to file to qualify for tax exemptions and other incentives. Law firms are equipped with accredited lawyers who can help you with your tax needs.

Chambers & Partners – Asia Pacific 2023

PDLegal LLC is pleased to announce that Managing Partner, Peter Doraisamy, has been recognised and ranked by Chambers & Partners (Asia Pacific 2023 for Shipping: Domestic: Litigation). The following quotes appear with Peter’s ranking: –

“Peter Doraisamy of PDLegal in Singapore is a noted shipping lawyer in the market. He handles a wide range of disputes, including ship grounding, cargo and fraud-related cases” – Chambers & Partners – Asia Pacific 2023

“He is excellent in litigation. He has very good control of the case, collecting the right evidence and putting this into a very successful trial.” – Shipping Litigation Client

Chambers and Partners is the leading independent professional legal research company operating across 200 jurisdictions. Chambers and Partners delivers detailed rankings and insights into the world’s leading lawyers and law firms.

This ranking is a testimony to the expertise and experience of the Firm’s shipping practice and would not be possible without the support of our clients and friends.

View All Awards

We’re here to help you

We know what’s at stake, and our lawyers ready for you – if you would like to speak to us for more information, please contact our client services team who will be happy to assist.

Let's Get In Touch

Our Office

- A:

PDLegal LLC Advocates & Solicitors 1 Coleman Street #08-02 The Adelphi Singapore 179803

- E:

- T:

- F:

(65) 6220 0392

- H:

Mon - Fri : 9:00 am - 5:00 pm Sat : 8:30 am - 12:00 pm